If you are now striving to improve your credit and get your budget, finances, and debt payments back on track post-pandemic, you are not alone. This is a significant problem and task for many consumers of all ages today. Unfortunately, no one knew while the world was experiencing all of the setbacks of Covid-19 just how powerful an effect it could have. As a result, both global and local economies, as well as every consumer’s bank account and wallet, suffered significantly.

Yet this recent weakening of your financial status or drop in your credit score need not become lasting damage. Instead, you can now take some time to evaluate your credit and take steps to repair and reinstate your former good standing. Then you can once again enjoy the many valuable benefits of having good, and even excellent, credit.

Steps to Repair and Improve Your Credit Post-Pandemic

You can start to repair or improve your post-Covid-19 credit score today by taking the following helpful steps:

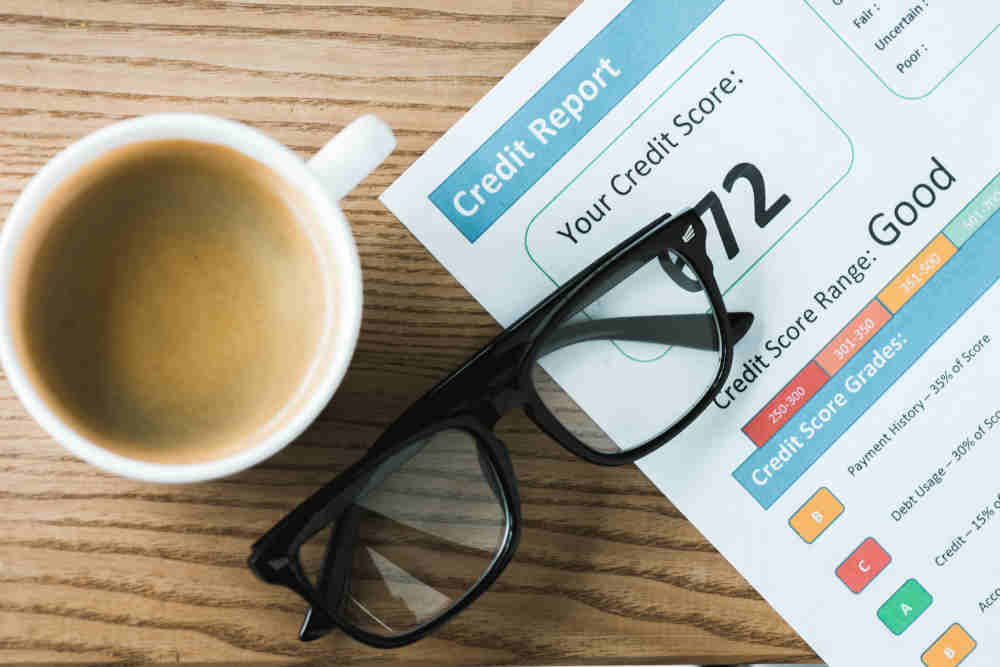

Review Your Credit Report Carefully

You may be accustomed to reviewing your credit report carefully once every year, checking it periodically afterward for any significant changes. However, after the pandemic, many consumers have credit reports that include numerous late payments and increased amounts of debt.

After obtaining a copy of your credit report from all three of the credit bureaus, Experian, TransUnion, and Equifax, check these reports thoroughly. Examine each report for any possible errors. For example, if you were granted any lower or deferred payments from a lender, ensure that your credit report does not indicate that you made late or insufficient payments.

Stay in Contact with Your Lenders and Creditors

Many banks and lending companies offered relief plans for borrowers during the Covid-19 pandemic. They typically accepted deferred payment schedules and waived most late fees. The majority of these relief plans only lasted for a few months, however. By maintaining contact with your lenders and creditors, you will know what helpful programs are currently available and offered as long-term credit rebuilding and enhancement plans.

Design a Credit Repair and Improvement Plan

The sooner you take swift action to repair or strengthen your credit score, the sooner you can enjoy the benefits of good credit again. First, structure a blueprint for paying down debt, starting with past-due accounts. This will help restore your record to showing on-time payments. It will also prevent you from accumulating late fees or other penalties, which can lower your credit score more.

After bringing your accounts current, check your credit utilization status. This reveals the amount of available credit you are now using. FICO recommendations are that you maintain a debt of less than 30 percent of your available credit.

Structure Your New Post-Pandemic Budget

You may have returned to your office, showroom, retail store, or other places of business by now. If you have the entrepreneurial spirit, you may have even started your own business during Covid-19. In either instance, you should now create a budget that aligns with your current situation.

If your debt has increased, you can reduce some areas of your spending to enable you to pay down this debt. For example, funds that you previously saved for travel can be used today to help rebuild or improve your credit rating.

By starting and building an emergency savings account now, you can be better prepared for any possible future financial emergencies. In addition, this will prevent you from needing to rely on high-interest credit to cover any such financial crunches.

Financial experts and advisors recommend saving from three to six months of your living expenses in a savings account or other liquid savings plan. This can enable you to weather the storm if any future economic downfalls or setbacks should occur.